michigan sales tax exemption for manufacturing

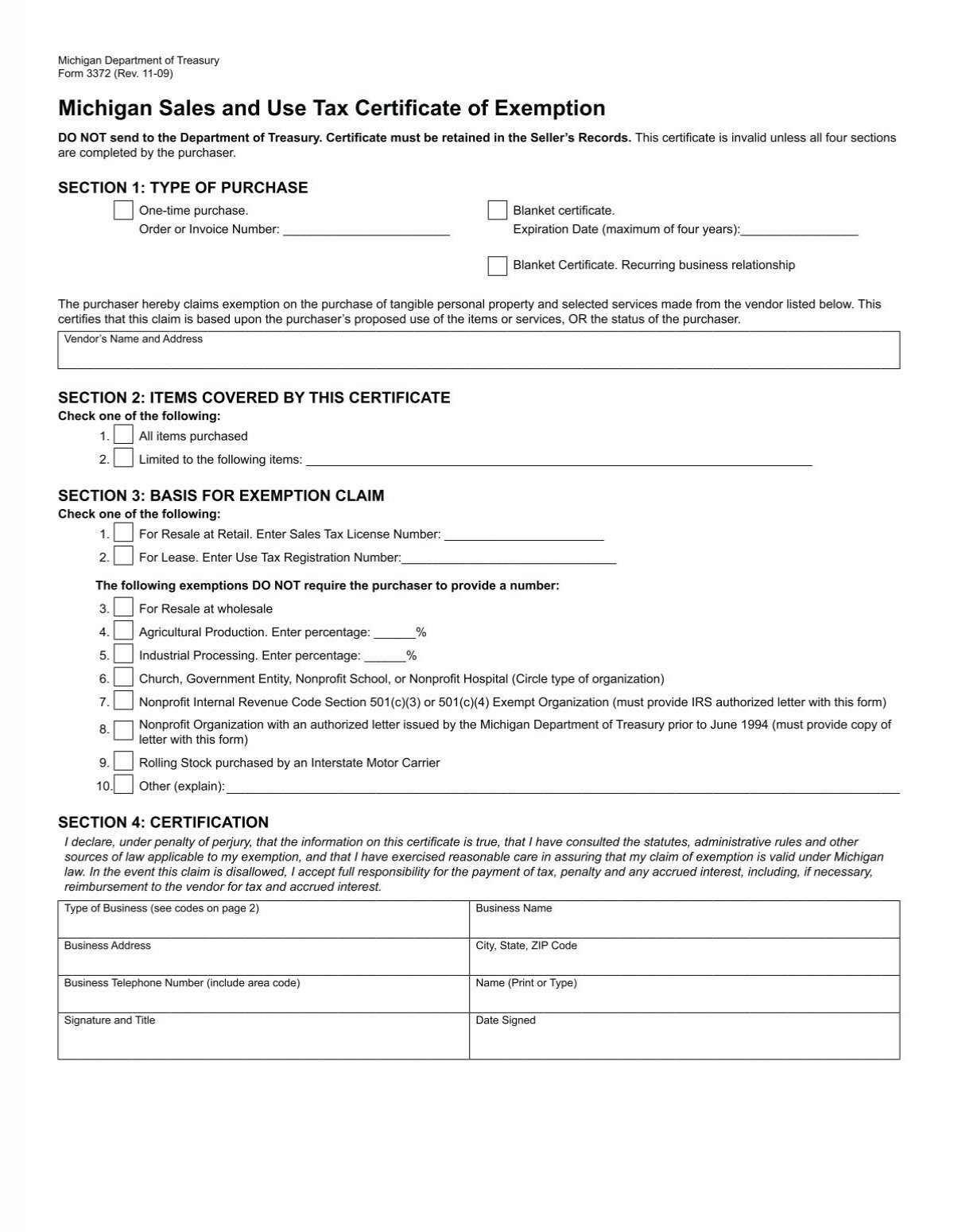

Michigan case law has long held that a three-factor test is applicable in determining whether property remains tangible personal property or becomes part of the realty. Michigan Sales and Use Tax Certificate of Exemption Then please mail the form to.

Ad New State Sales Tax Registration.

. Purchase the Sales Tax Exemptions book. To learn more see a full list of taxable and tax-exempt items in Michigan. Notice of New Sales Tax Requirements for Out-of-State Sellers.

Start recognizing the sales tax exemptions learn how to review the production process and pay the correct sales tax to the great state of Michigan. This tax exemption is authorized by MCL 20554t 1 a. Michigan Department of Treasury Tax Compliance Bureau Updated March 2019 Page 8 of 98.

The Sales Tax System set for Michigan uses five tax-training books to educate and train employees on how to review the manufacturing sales tax processes. The sales tax book is an alphabetical listing of typical manufacturing purchases which start with advertising and ends up with warranty repairs. Small Business Taxpayer Exemption Eligible Manufacturing Personal Property and Act 328 New Personal Property.

Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to production or assembly research development engineering re-manufacturing and storage of in-process materials. Sales Tax Exemption List information registration support. Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long as the equipment is used in industrial processing activities.

The Exempt and Taxable Purchases book for Michigan is a great training tool for the accounts payable department to research and verify taxability of purchases. Ad Fill Sign Email MI Form 5076 More Fillable Forms Register and Subscribe Now. Of the general sales tax act 1933 PA 167 MCL 20554t or section 4o of the use tax act 1937 PA 94 MCL 20594o.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. All fields must be. Five Hot Spots for Manufacturing Sales Tax Exemptions.

Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. If you would like to file for Tax Exempt status please complete the following form we will update your tax status upon receipt of. Ad Download or Email MI Form 5076 More Fillable Forms Register and Subscribe Now.

05 Government 14 Non-Profit Educational. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce tangible. Our training system set delivers the following benefits.

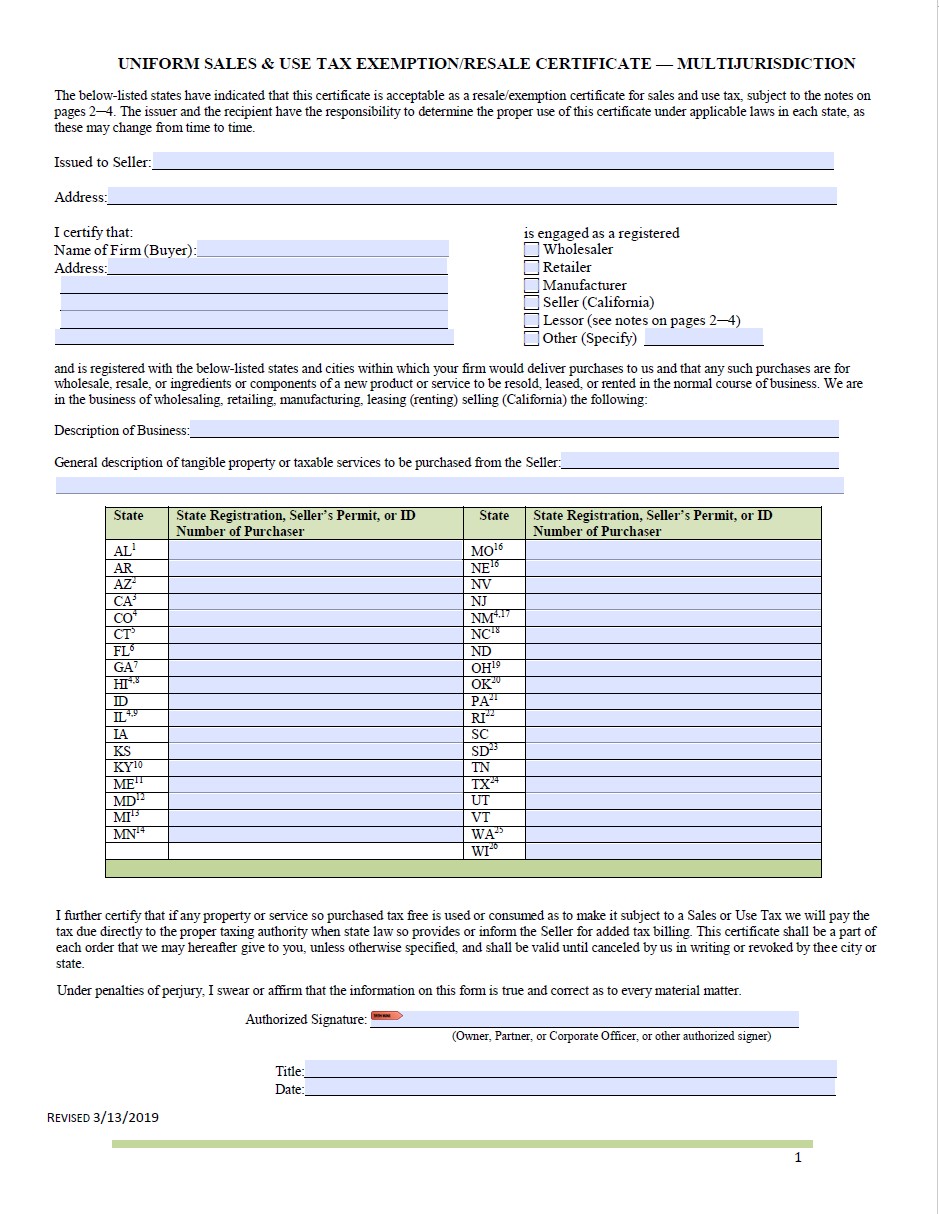

Of Treasury Industrial Processing Manual. Or finished products may be exempt from tax. The buyer must present the seller with a completed form at the time of purchase.

For example Texas allows manufacturers to claim and exemption when purchasing gas and electricity used in powering exempt manufacturing equipment other than equipment used in preparation or storage of prepared food Tax Code 151317. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet by mail or by phone from out-of-state retailers that do not collect and remit sales or use tax from their. 04 Manufacturing 13 Non-Profit Hospital.

The dies are exempt because they are used by an industrial processor Subsidiary Corp in an industrial processing activity. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

06 Rental or leasing 15 Non. For example a service whos work includes creating or manufacturing a product is very likely considered to be taxable and thus you would. Its important to note that this now applies to employee purchases and not just the exempt.

Legislation enacted in 2016 created an exemption from sales and use tax on purchases of tangible personal property affixed to and made a structural part of county long-term medical care facilities retroactive to tax years beginning after Dec. This page discusses various sales tax exemptions in Michigan. For more information on exemption requirements and the procedures to claim an exemption see Revenue Administrative Bulletin 2002-15.

The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language. In Michigan machinery equipment or materials used within a plant site or between plant sites operated by the same business for movement of work in process may be exempt from. This link will provide information on each of these exemptions including determining eligibility and how to claim the exemption.

Adjourned until Tuesday June 7 2022 100000 AM. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Use tax is a companion tax to sales tax.

However if provided to the purchaser in electronic format a signature is not required. This page describes the taxability of manufacturing and machinery in Michigan including machinery raw materials and utilities fuel. Taylor Atwood CMI Manager Sales Use Tax.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax. The General Property Tax Act provides for exemptions for certain categories of personal property including. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Industrial processing does not include the generation. 2 Michigan then enacted a law in 2017 providing a sales and use tax exemption for the sale. Liable for sales or use tax on the purchase of the dies delivered to it in Michigan.

Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Several examples of exemptions to the states. Sales Tax Exemptions in Michigan.

The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process. An Industrial Facilities Exemption IFE certificate entitles the facility to exemption from ad valorem real andor personal property taxes for a term of 1-12 years as determined by the local unit of government. While most services are exempt from tax there are a few exceptions.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. A restaurant bakery or caterer may be able to claim an exemption on equipment but the exemption does. Michigan sales tax exemption for manufacturing.

Sales Tax Exemptions in Michigan. A vital internal control is to prove and document the manufacturing sales tax exemptions to ensure the proper administration of the sales tax system. Identify Michigans manufacturing sales tax exemptions and requirements Instruct employees on how to exam and evaluate the.

Ohio Revenue Code Ann. Applications are filed reviewed and approved by the local unit of government but are also subject to review at the State level by. Streamlined Sales and Use Tax Project.

Download Policy Brief Template 40 Brief Executive Summary Ms Word

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

Mi Sales Tax Exemption Form Animart

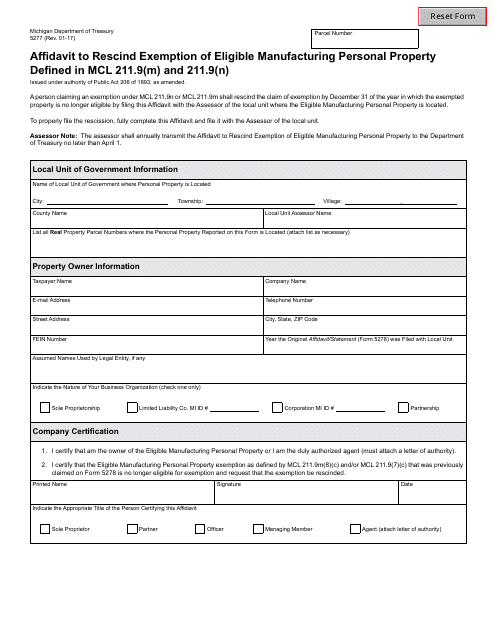

Form 5277 Download Fillable Pdf Or Fill Online Affidavit To Rescind Exemption Of Eligible Manufacturing Personal Property Defined In Mcl 211 9 M And 211 9 N Michigan Templateroller