starting credit score in india

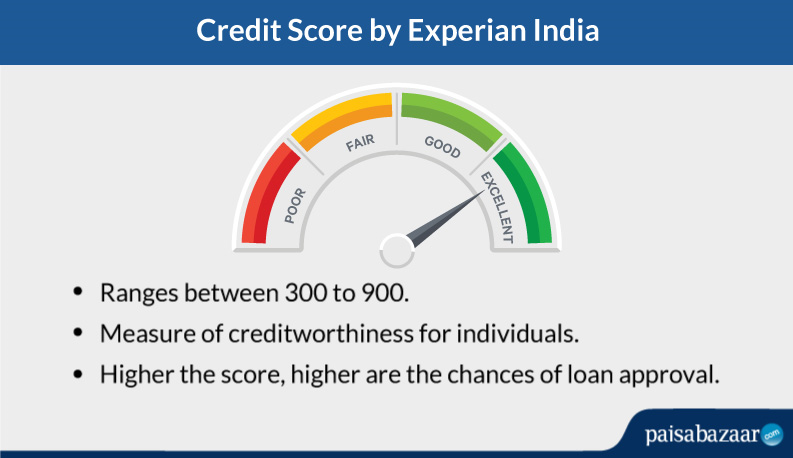

While a score between 300 and 549 is deemed to be poor anything from 550 to 700 is deemed to be fair. A credit score helps lenders evaluate your credit profile and influences the credit thats available to you including loan and credit card approvals interest rates credit limits and more.

Do You Want To Improve Your Cibil Score In India Here Are Some Important Tips That Helps You To Increa Loans For Poor Credit Check And Balance Unsecured Loans

For example most FICO Credit Scores range from 300-850 based on your credit history and can be viewed as a summary of your credit report.

. Who says you cant have it easy. CIBIL scores can range anywhere between 300 and 900 with 900 denoting maximum creditworthiness. A few lenders also provide home loans if your credit score is 550 or more.

So 30 of your 500 limit or 150. Free Credit Consultation One of our Specialized Credit Consultants would give you a call to explain the credit report in-depth its issues and if it can be fixed. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number.

Unsecured Credit Card The unsecured credit card is the best option to build your credit score but beginners usually cannot avail it due to no credit history. Apply Now Personal Loan Overview. Starting credit score in india Wednesday May 11 2022 You have to give yourself 6 months to a year for your repayment history to reflect as a credit score.

Thats because your credit score doesnt start at zero. It will aid in qualifying you for personal loans and credit cards. However if your CIBIL score is below 750 you will find it harder to borrow funds from banks and NBFCs.

Check Free Credit Score Online Tata Capital Personal Loan Personal Loans at Tata Capital are unique and flexible. The closer the score is to 900 the better it is considered. Your credit score is decent for a newbie with no credit history.

From a banking perspective this is the start. Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score. CIBIL Score is the credit score issued by CIBIL Indias first credit bureau and ranges between 300 to 900.

There are two types of credit cards that you can apply for secured and unsecured. Scores belonging to either category can be improved. The 4 major credit bureaus operating in India are- TransUnion CIBIL Equifax Experian CRIF Highmark How to Check Your Credit Score for free Each of the 4 credit bureaus TransUnion CIBIL Equifax Experian and CRIF Highmark generates its own credit report and score.

The answer may surprise you. Take a step to attain financial freedom Get these features when you take a Free CIBIL Score Report. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period.

Lenders seeking to grow portfolios without sacrificing risk standards must adopt new practices as well as analytic tools in order to gain a more complete consumer view one that leverages data beyond an existing book of business to build intelligence. An ideal credit score in India is 750 or above if you are applying for a home loan. If the reporting agency is seeing you continually over 150 its not helping your score.

You simply wont have a score at all. We offer quick and easy finance at competitive interest rates. A CIBIL score of 750 or above in your credit report is ideal.

Our Personal Loan is built around your needs. Identify Frauds and Errors Check for any fraudulent enquiries or errors in your credit details. The reason being lower the credit score the lower will be the amount sanctioned for the loan.

Checking your own credit score doesnt impact it. 5 Strategies My Husband And I Used To Get A Credit Score Of 800. Do you begin at a the highest possible credit score b the lowest or c somewhere in between.

The closer the. Applying for a credit card is the easiest and the most common way to build your credit score on your own. A score above 750 is considered to be an excellent score.

Starting with no credit score doesnt mean your score is zero. The more you score to achieve 900 the greater you get credit card approval process. In 3 easy steps Step 1.

Its d none of the above. In reality everyone starts with no credit score at all. Best Credit Cards In India 2022.

You wont start with a score of zero though. The interest rate differential on a loan for someone with a credit score of 700 and 800 is estimated to be around 20-30 basis points bps. But yes continue to pay it off.

What Is A Good Credit Score Forbes Advisor A score above 750 is considered to be an excellent score. The score is derived using information from all past credit transactions and loans. Show arrow or link so it goes back to form Step 2.

Should have a minimum credit score of 750. Focus on understanding the factors that impact your credit score and take conscious measures to improve it. Your Credit Score Doesnt Start at Zero.

For instance some lenders only approve 60-65 of the loan amount for a low credit score. Without an established history your credit report and credit score dont magically appear when you turn 18 despite many common misconceptions. Its recommended to stay under about 30 of total credit utilization.

Starting credit score in india Thursday May 5 2022 Edit Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card. Claim your Credit Report We will generate your Credit Report simply by filling up the form above. With us all it takes is a click.

You can refresh it once a year. A credit score is a number that is assigned to people and businesses that have a financial history of borrowing and repaying debt. We have put together a list of the 10 best credit cards in India.

The lending environment in India is becoming more saturated and competitive. Access CIBIL Dashboard View your CIBIL Score and Report. Since everyones credit journey is different theres no one standard score everyone starts out with.

Thats because your credit scores arent calculated until a lender or another entity requests it to determine your creditworthiness.

How Do I Start Investing On Peer To Peer Lending Platform The Complex And Tedious Processes In The Most Investm Start Investing Investing Peer To Peer Lending

5 Fumbles That Can Seriously Mess With Your Credit Score In 2021

Different Ranges Of Credit Scores Good Bad Credit Score Range

Do You Know A Low Cibil Score Can Literally Change Your Life Scores Did You Know Change

A Cibil Score Is The Most Important Criteria For You To Get Access To Credit Products Factors That Affec Credit Repair Services Good Credit Credit Restoration

Increase Your Credit Score With This Simple To Follow Step By Step Guide Credit Repair Credit Repair Letters Fix Bad Credit

What Is Cibil Score Or Credit Score Best Tips 2021

Worried About Your Credit Score You Can Build It Right Away Stucred Comingsoon Staytuned Credit Score Easy Loans Informative

5 Things In Your Everyday Life That Are Affected Because Of Low Cibil Score In 2021 Life Scores Balance Transfer

Top Credit Scoring Startups In India That Use Ai Credit Score Start Up Financial Institutions

Goodcibilscore Depend On Your Credit History Better Your Credit History Higher The Cibil Score Improve Your Credit Score Credit Score Personal Loans

Credit Score Credit Score Improve Credit Score Improve Credit

Know How Cibil Score Is Important For Personal Loan Fintrakk Credit Score Personal Loans Good Credit Score

Credit Score Improve Credit Score Improve Credit Credit Score

No Credit History Here Is How You Can Build One

Pin On P2p Lending India Infographics

Get Your Credit Score Free In Less Than 3 Minutes What Is Credit Score Credit Score Good Credit

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

Experian Credit Score Check Free Experian Cibil Score Get Credit Report